Who is Winning the Covid-19 Insurance Coverage Fight?

Who is Winning the Covid-19 Insurance Coverage Fight? It depends on where the lawsuits are being decided. In state court, policyholders are winning roughly one half to three quarters of all lawsuits filed. The one half number is for lawsuits containing virus exclusions, and the three quarters number is for lawsuits without a virus exclusions. Federal courts, however, are much more favorable to insurers. The result — insurance carriers are fighting to have federal courts decide Covid-19 cases. Statistics, however, do not explain everything. Policyholders need to look deeper into these statistics to understand why litigation strategy is perhaps more important than the merits of any given claim. But first, some context.

I. The Onslaught of Covid-19 insurance Coverage Lawsuits

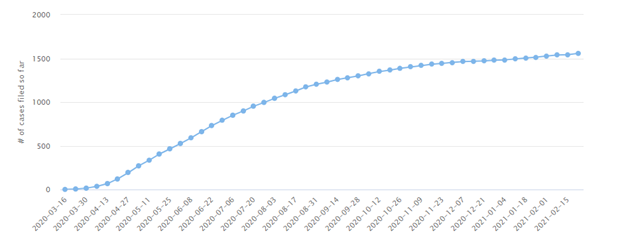

Just over a year ago, the seemingly never-ending onslaught of lawsuits started. Soon as the pandemic hit, almost immediately, plaintiffs’ lawyers began filing suit. To date, over 1500 lawsuits seeking insurance coverage for Covid-19 related business losses have been filed.

These early lawsuits were not the kind of lawsuits that seasoned insurance lawyers were accustomed to. Historically, insurance coverage law revolved around large well-funded corporations fighting equally large or larger well-funded insurance companies. Not here. What we saw was a grassroots phenomenon, with small businesses like mom-and-pop restaurants, nail salons, barber shops, tanning salons, and the like, bringing lawsuits against insurers. For the first time in the history of insurance law, traditional plaintiff lawyers were making insurance coverage litigation and class action lawsuits “a thing” for small businesses who otherwise would never have been able to seek justice.

Many of these early lawsuits addressed policies containing a standard-form ISO VIRUS OR BACTERIA EXCLSION. Many of these early lawsuits did not allege that the virus causing Covid-19 caused physical loss or damage to property. Instead, they argued that other causes, such as government closure orders, led to their losses.

Cumulative Covid-19 Insurance Coverage Actions

Source: https://cclt.law.upenn.edu/

As time went on, larger more sophisticated businesses reviewed their coverage and began filing lawsuits. Unlike coverage sold to many smaller businesses, much of this coverage addressed exclusionary language that was markedly different from that contained in the standard ISO form. In many cases, the policies at issue did not contain any form of virus exclusion. In others, the exclusionary language was amended by state specific endorsements deleting viruses from the exclusion, or the exclusion was drafted in such a way that it applied only to certain costs expended, and not business interruption losses themselves. Accordingly, many of the early rulings pertinent to policies with a standard ISO exclusions did not apply to claims brought by larger organizations.

II. Insurance Industry Response

Insurance carriers saw their exposure to Covid-19 claims from the start and conducted some very impressive public relations and lobbying to limit their liability.

Initially, many commercial insurance brokers advocated on behalf of the insurance companies. For example, a major multinational broker, AON, stated in one of its client advisory pieces

“[m]ost property policies, including ISO, specific insurer forms and most manuscript policies, do not cover a loss resulting from a virus.”

Similarly, Willis Towers Watson stated, that there was

“[v]ery limited, if any coverage.”

But not everyone fell in line. The Independent Insurance Agents & Brokers of America, an insurance broker trade association, was outraged at the approach the insurance industry had taken withCovid-19 claims, stating

“insurance carriers are directing their agencies to deny certain claims related to the COVID-19/coronavirus . . .some carriers have even put this directive in writing.”

Insurance company lawyers were next to come to the defense of their clients. Just four days after the WHO declared Covid-19 as a pandemic, insurance company lawyers began publishing articles arguing that coronavirus claims are excluded from coverage. See Coronavirus excluded for over 15 Years, According to Insurance Company Lawyers

Aggressive insurance company lobbying soon followed. States like New Jersey, Ohio, Massachusetts, and Pennsylvania all had pending legislative proposals requiring insurance companies to cover Covid-19 claims. With involvement of insurance company lobbyists, those laws appear to have been quickly defeated. Congress even wrote a letter to various industry trade associations, urging their member companies “to make financial losses related to COVID-19 . . . part of their commercial business interruption coverage for policyholders.” The insurance industry’s collective response: no thanks. This could, according to insurance company lawyers, bankrupt the industry. See Reuters Article Where Insurance Company Lawyers Argue it is Better for them if They Can Just Get Paid to Litigate Covid-19 Claims.

Instead, the insurance industry offered support for a new Federal Government program where taxpayers would pay for business losses and insurance companies would be paid to administer that new program. See Politico Article. The insurance companies argued – everyone is on board; taxpayers should shoulder the burden. They were supportive of legislation, so long as they did not have to pay for Covid-19 claims.

III. Kinds of Covid-19 lawsuits

With their significant resources and political connections, it was perhaps an easy lift for insurance companies to defeat proposed legislation. But litigation is a different story. To answer the question of who is winning the Covid-19 insurance coverage fight, it is first helpful to break down the different kinds of litigation bring brought in different courts. Although the language of each insurance policy needs to be independently analyzed, most Covid-19 cases fall into two distinct categories:

- Lawsuits over policies containing virus exclusions; and

- Lawsuits over policies not containing virus exclusions.

Covid-19 litigation raises novel coverage issues and insurance coverage that are determined by state law. It is also interesting to see how state courts decisions are different from federal court decisions.

1. Lawsuits Over Policies Containing Virus Exclusions

On the first category, policyholders are wining just over ten percent of all lawsuits, even when those lawsuits contain virus exclusions. At first glance, this number is deceivingly low. It helps to put this statistic into better context. For the most part, these are cases that contain the standard form ISO exclusion that excludes coverage for losses “directly or indirectly caused” by a virus.

Larger company policies typically do not contain the ISO exclusion that the courts so far have addressed. To date, courts have not opined on policies that have virus exclusions that have been subsequently deleted by state-specific endorsements. Nor have the courts addressed more prevalent contamination exclusions that carriers such as Chubb and XL have confirmed apply only to traditional pollution. For the most part, courts have not addressed exclusions that apply only to costs (hard expenditures), as opposed to loss (business interruption coverage).

One of the biggest issues courts have yet to address is the issue of causation with respect to virus exclusions. Courts almost universally recognize that there are at least four causes for policyholder loss:

- Covid-19 (the disease);

- The Pandemic;

- The virus; and

- Governmental closure orders.

Not every version of a virus exclusion approaches these causes the same way. For instance, a ruling on the standard ISO exclusion with broad “directly or indirectly caused” causation language has no bearing on an exclusion that applies only to losses “caused” by the virus. At most, only one of the four causes, the virus itself, would be excluded from coverage with the later language. For example, if the governmental closure orders caused the loss, coverage would be provided.

2. Lawsuits Over Policies Not Containing Virus Exclusions

Policyholders, on the other hand are winning roughly 30 percent of cases where the policies at issue do not contain a virus exclusion. Better odds for sure, but why so low? The answer, as explained in more detail below, is that federal courts appear to be creating their own law, rather than following state law.

3. State Court vs. Federal Court

The question of who is winning the Covid-19 insurance coverage fight is highly dependent on whether the claim is being decided in state versus federal court. Policyholders are wining roughly half of all cases filed in state court. This is despite the fact that most of the cases decided contain standard form ISO virus exclusions. And in most of the cases decided, for the same reason, the policyholder did not plead that the virus was the cause of the damage. If policyholders are winning half of these kinds of cases, that is good news.

The news gets even better, with policyholders winning roughly two thirds of cases decided in state court where no virus exclusion is present. The odds perhaps should be higher, but winning half to two thirds of all cases filed is a good start.

In federal court, the odds drop down significantly. Overall, policyholders win only about ten percent of the time in federal court, and just fourteen percent of the time in federal court when there is no virus exclusion. The following table indicates just how different the outcomes are between state and federal courts is in the context of Covid-19 claims.

Percentage of Policyholder Victories

| State Court | Federal Court | |

| Virus Exclusion | 33% | 4% |

| No Virus Exclusion | 66% | 14% |

Based on statistics alone, something is drastically off. Federal courts are not following state law. The question of whether federal courts have the authority to create state law is not a novel issue. Not only do federal courts have better things to do than decide state law insurance issues, but they are prohibited from creating new state law on issues of contract interpretation. SeeErie Railroad Co, v. Tompkins, 304 U.S. 63 (1938).

IV. Litigation Strategy

This explains why insurers are hell bent on having their disputes decided in federal Court. Federal courts are known to be generally more favorable to insurers than state courts, but the difference for Covid-19 cases is far beyond what any rational person would expect.

For many larger organizations, the insurers have taken the position that they should not deny claims outright. Rather, they are conducting mock investigations with no intent to pay any Covid-19 claims. The benefit of this strategy is that some policyholders commit unintentional errors by missing suit limitations or proof of loss deadlines set forth in the policies.

Policyholders in this situation can and likely should file declaratory judgment actions, not breach of contract actions. First, the insurer, in this situation, may technically not have breached the contract, at least not yet. So, a single declaratory judgment action is appropriate. Second, if there is diversity jurisdiction the insurer will remove the action to federal court where their odds are five to ten times better than if the action remained in state court. If the policyholder filed a declaratory judgment action only, the policyholder should then file a Brillhart Abstention motion. See Brillhart v. Excess Insurance Co. of America, 316 U.S. 491 (1942) (recognizing that federal courts should abstain from exercising jurisdiction over state insurance law cases). In fact, the proliferation of Covid-19 insurance coverage actions presenting similar questions of state law interpretation strongly suggests that federal abstention would be appropriate.

Insurers now claim unless we revisit 80 years of established law, they could suffer defeat. This is not a valid reason to reevaluate legal precedent.

* These statistics are for cases decided in state court. Victory is defined as defeating an insurers’ motion to dismiss or prevailing on summary judgment.