New York has taken a two-prong approach to dealing with sexual abuse claims. First, the state legislature enacted the NY Child Victims Act. Second, New York publicly called out insurers telling them that providing Insurance Coverage for Child Victims Act Claims should be one of their highest priorities. See Insurers Should Prepare to Promptly Handle Wave of Child Sex Abuse Claims.

The state Department of Financial Services, in a guidance, told insurers they should be prepared to promptly approve coverage for those claims, when applicable, or face state action.

Based on our experience, many insurers are not treating policyholders fairly, and they are not promptly handling these kinds of claims. This was the subject of a recent PLI CLE Seminar where we addressed in detail some of the insurance implications we are seeing for Child Victims Act Claims. For additional information, please see PLI Seminar Course Materials.

What is the Child Victims Act?

Influenced by horrific, widely publicized incidents of sexual abuse, such as the ongoing Catholic Church scandal, and Larry Nassar’s widespread abuse of gymnasts, many states are revisiting how sexual abuse claims are handled in court. New York’s recently enacted Child Victims Act is a prime example.

The Child Victims Act revives claims for childhood sexual abuse or molestation that might otherwise be barred by statutes of limitation. Among other things, the Act creates a one-year window for claimants to file claims against their alleged abusers. That window for claims recently opened on August 14, 2019 and closes on August 14, 2020. Virtually any organization that works with children may be subject to liability.

In New York, a considerable number of Child Victims Act lawsuits were filed when the window opened for claims on August 14, 2019.

- By 5:00 a.m. on the first day that lawsuits could be filed, roughly 200 lawsuits were filed;

- On the first day, over 400 lawsuits were filed;

- In the first two days, over 500 lawsuits were filed.

Plaintiffs’ lawyers contend that what we have seen to date is only a small portion of the lawsuits they intend to file.

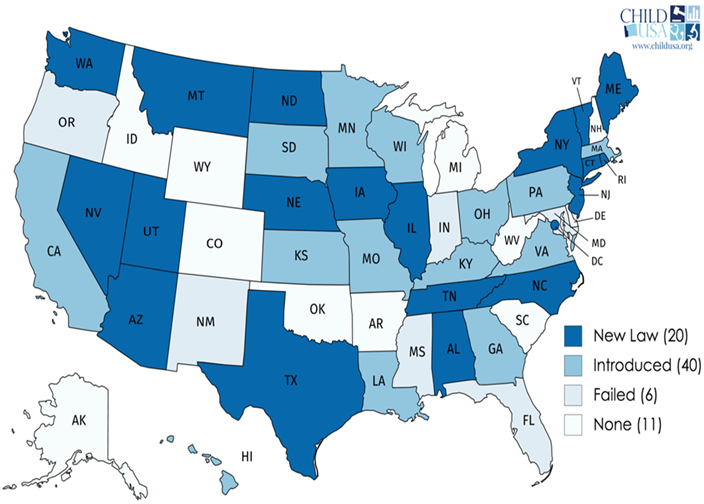

New York is just one of many jurisdictions passing similar Child Victims Act laws. Child USA, reports that the vast majority of states have either passed or introduced laws extending the statute of limitations for child victims.

Insurance Coverage for Sexual Abuse Claims

Insurance coverage for sexual abuse claims is part of the solution. See Securing Insurance Coverage for Child Victims Act Claims Although insurance typically covers revived sexual abuse claims under the NY Child Victims Act and similar laws, insurance carriers don’t always see it this way. See Archdiocese of N.Y. v. Ins. Co. of N. Am., (N.Y. Sup. Ct. July 1, 2019); Rockefeller Univ. v. Aetna Cas. & Sur., (N.Y. Sup. Ct. Aug. 6, 2019).

Where plaintiffs seek financial compensation, insurance is always part of the solution. But, as we have seen with many of our clients facing claims for sexual abuse or harassment claims, many insurance carriers are circling the wagons to protect their own financial interests, rather than protecting their policyholders. Below is a list of some of the issues policyholders should consider:

1. Policies Providing Coverage

Two types of policies most commonly provide coverage: (1) Directors and Officers/ Employment Practices (D&O/EPLI) Policies and (2) General Liability (GL) Policies.

General Liability policies are the first kind of policy most policyholders think of when considering coverage. These “occurrence-based” policies cover allegations of bodily injury taking place during the policy period. Accordingly, numerous policies may be triggered by a claim and respond to a loss.

D&O/EPLI policies, by contrast, are just as important. Many D&O or management liability policies expressly cover sexual harassment. See Village of Piermont v. Am. Alt. Ins. Corp., 151 F. Supp. 3d 438, 441 (S.D.N.Y. 2015) (sexual assault covered under D&O policy). Allegations against institutions for actions of their employees often fall squarely within D&O/EPLI coverage. Unlike GL Policies, however, the triggered policy is the one in place when the claim is made, as opposed to the ones in place when when the alleged bodily injury occurred.

2. Providing Notice

Providing notice for these kinds of claims can be one of the most complicated and important things that a policyholder does. Some of the issues with notice include:

- Does providing notice under one policy preclude coverage under another?

- How do prior claims and prior notice provisions impact notice?

- What exactly does each policy require for notice?

- What is the legal consequence of providing improper notice?

- Should the policyholder request authority to incur defense costs?

- Should the policyholder seek consent to hire defense counsel?

- Where must notice be sent, and how?

- What does the law say about notice provided in a manner different from what is provided for under the policy?

- What additional requests must be included with notice, and how do those requests vary from policy to policy?

- Under which policies should notice be provided?

- How important is it to search for additional policy information, and how should that search be conducted?

Providing notice properly requires time, thought, and legal analysis. In practice, many policyholders delegate this process to insurance brokers. Given the complexity of the issues, astute policyholders may want coverage counsel involvement at this stage of a claim.

3. Responding to Insurer Information Requests

Once notice is provided, policyholders should expect an onslaught of requests for information.

Managing insurance companies’ requests for information is no easy task, but two important ground rules need to be considered. First, insurance companies will request information that is designed to create defenses to coverage. Ironically, the same information requested by the insurers may harm the policyholders’ defense of the underlying claims. Second, information requests are inapplicable to defense of a claim. Defense obligations are typically controlled by what is known as the eight-corners rule. An insurer is permitted to review the four corners of the underlying complaint, and compare the allegation therein to the four corners of the policy. Based on this limited information, the insurer is required to either provide a defense (pay for defense counsel) or disclaim coverage.

Accordingly, policyholders should demand that the insurance carrier provide a coverage determination before engaging in requests for information designed to harm both coverage and defense of the claim.

4. Alleged Coverage Defenses to Sexual Abuse Claims

Insurers routinely raise a number of different reasons for not paying sexual abuse or harassment claims. An analysis of these so-called defenses, addressed from the perspective of a leading insurance company, is found in Munic Re’s 2010 study “Coverage and Liability Issues in Sexual Misconduct Claims.”

Three prominent insurance company arguments to defeat coverage include (1) sexual abuse exclusions, (2) no “occurrence”, and (3) policy not triggered.

Sexual Abuse Exclusions

Sexual abuse exclusions are not standard form, and do not appear uniformly in all policies by year. They may be found in some policies starting in the 1990s, but even then, they oftentimes come and go for an individual policyholder. More favorable versions expressly provide for a defense. Like all exclusions, they are construed narrowly and any ambiguities are construed in favor of coverage.

Just because a sexual abuse exclusion is present does not mean that coverage is precluded. The default rule is that the exclusion is severable, meaning that it may apply to an individual who is alleged to have perpetrated the abuse, but it does not apply to the organization who hired that individual. Moreover, allegations of negligence, false imprisonment, etc., should not trigger exclusion. SeeVillage of Piermont v. Am. Alt. Ins. Corp., 151 F. Supp. 3d 438, 451 (S.D.N.Y. 2015) (exclusion invalid as to false imprisonment claims).

Finally, and most obviously, policies that do not contain exclusions provide coverage. For example, there may be sexual abuse exclusions in policies starting in the late 1990s and thereafter, but that does not impact coverage for allegations of bodily injury taking place prior to that time. Similarly, a current D&O policy may contain such an exclusion, but the EPLI or Employment Practices Liability coverage section found in that same policy likely would not contain such an exclusion, because EPLI policies are designed to cover and do cover sexual harassment claims.

Occurrence — Neither Expected nor Intended from the Standpoint of the Policyholder

In a typical GL policy, “occurrence” may be defined as “an accident, including continuous or repeated exposure to substantially the same general harmful conditions. . . . which is neither expected nor intended from the standpoint of the insured.” Although the definition varies over time, it raises two important issues with respect to sexual abuse or harassment claims. The first is the number of occurrences. The second is coverage for expected or intentional versus negligent conduct.

Determining the number of occurrences can be a touchstone issue in these kinds of cases. Multiple occurrences means multiple policies are triggered (giving rise to increased limits), but it can also trigger multiple deductibles. Unfortunately, legal tests seldom provide a bright line answer. For example, New York applies the “unfortunate event” test. Roman Catholic Diocese of Brooklyn v. Nat’l Union Fire Ins. Co. of Pittsburgh, Pa., 991 N.E.2d 666, 672 (N.Y. 2013). The unfortunate event test requires consideration of “whether there is a close temporal and spatial relationship between the incidents giving rise to injury or loss, and whether the incidents can be viewed as part of the same causal continuum, without intervening agents or factors.” Id. Unfortunately, the test does not lend itself to one absolute and indisputable outcome in the context of a school that is sued for the negligent hiring of a perpetrator who allegedly abused multiple victims.

The “neither expected nor intended” part of the “occurrence” definition clearly favors policyholders. Here, many insurance carriers paint with a broad brush, claiming that everything is intentional, and thus, not covered. These arguments, at most, apply only to perpetrators. The neither expected nor intended argument does not apply to organizations facing negligence-based claims.

Trigger

When I was a young insurance coverage lawyer in the early 1990s, many coverage lawyers immersed themselves in the intricacies of trigger law. Now, virtually everyone who can read an insurance policy agrees that all GL policies in place during the time of bodily injury are triggered. Long gone are creative insurance company arguments attempting to limit the triggering of GL policies to one and only one policy period. That fight is over and the insurers came out on the wrong end of history.

Now, there are two accepted variations of the rule that all policies in place during the time of bodily injury are triggered: the All Sums approach, and the Pro Rata approach.

Under the All Sums approach, the policyholder can collect its total liability under any one triggered policy, up to policy limits. Matter of Viking Pump, Inc., 27 N.Y.3d 244, 255-56 (N.Y. 2016); Keyspan Gas E. Corp. v. Munich Reins. Am., Inc., 31 N.Y.3d 51, 58 (N.Y. 2018). Conversely, under the Pro Rata approach, each insurance carrier is allocated a “pro rata” share of the total loss covered under the various policies for the portion of the loss occurring during its policy period.Keyspan Gas, 31 N.Y.3d at 58. New York has not adopted a strict “all sums” or “pro rata” allocation rule. Viking Pump, 27 N.Y.3d at 257; Keyspan Gas, 31 N.Y.3d at 58.

5. Settling Insurance Claims — Best Practices

We have found that settlement of insurance claims for sexual abuse and harassment should be conducted in two phases: first defense, and second indemnity.

Before settlement with an underlying claimant can be addressed, policyholders need to secure coverage for defense of the claims asserted against them. The first step here is to create a coverage chart (time on the X axis, and dollars on the Y axis) indicating the policies available for various years of alleged injury. Then, create an overlay of when the allegations in the complaint took place to understand which policies are triggered.

From a legal standpoint, any triggered GL carrier is obligated to provide a defense for the entire action. Although one might think that this concept is a powerful thing, which is is, it does not always facilitate settlement because insurers are often more concerned about how much the other carriers will pay, than how much they will pay themselves. Getting things going requires a proactive approach, getting all of the insurers in one room, and hammering out a defense funding agreement.

Once a defense funding agreement has been reached, insurers should be approached for contribution, or indemnification for settlement with the underlying claimants. If the insurance carriers refuse to cooperate, litigation may be the best option. We have been repeatedly told by mediators that early mediation with insurers does not work unless a complaint has been filed. In our experience, litigation is the best way to get an insurance carrier to move.

The volume of child abuse cases filed is challenging the courts and discussions appear to be underway to structure an Alternate Dispute Resolution (ADR) process. Insurers will participate in that ADR process, but policyholders need to be prepared with respect to legal issues raised by the insurers, and they should not be afraid to use litigation against their insurance carriers as a tool to promote justice.

Finally, the law relating to settlement of claims with or without insurance carrier consent is difficult to navigate. The general rule is that a policyholder should not settle a case without consent from the insurer. There are exceptions to this rule, such as when an insurer has denied coverage for the claim. And, there are proven ways to obtain consent if a carrier is recalcitrant. If insurance coverage is important, a claim should not be settled without first contacting coverage counsel.

.

6. Trial – best practices and perspectives

6. Trial – best practices and perspectives